A 1099 form is an important document used for various tax purposes. It is typically used to report income received that is not necessarily from a standard employer-employee relationship. Instead, it is used to report income earned as an independent contractor, freelancer, or from other sources such as rental income, interest payments, or royalties. The form provides the necessary information for individuals and businesses to accurately report their income to the Internal Revenue Service (IRS).

1099 Form Printable 2018 | MBM Legal

If you are looking for a printable version of the 1099 form for the year 2018, MBM Legal provides a convenient option. Having a printable version of the form can be useful for those who prefer a physical copy or those who need to distribute multiple copies to recipients.

If you are looking for a printable version of the 1099 form for the year 2018, MBM Legal provides a convenient option. Having a printable version of the form can be useful for those who prefer a physical copy or those who need to distribute multiple copies to recipients.

Printable 1099 Tax Forms Free - Printable Form 2022

For those who need to prepare their 2022 tax returns and are in search of free printable 1099 tax forms, Printable Form provides a downloadable and printable version. This can save you time and effort, allowing you to easily fill out the necessary information and include it with your tax return.

For those who need to prepare their 2022 tax returns and are in search of free printable 1099 tax forms, Printable Form provides a downloadable and printable version. This can save you time and effort, allowing you to easily fill out the necessary information and include it with your tax return.

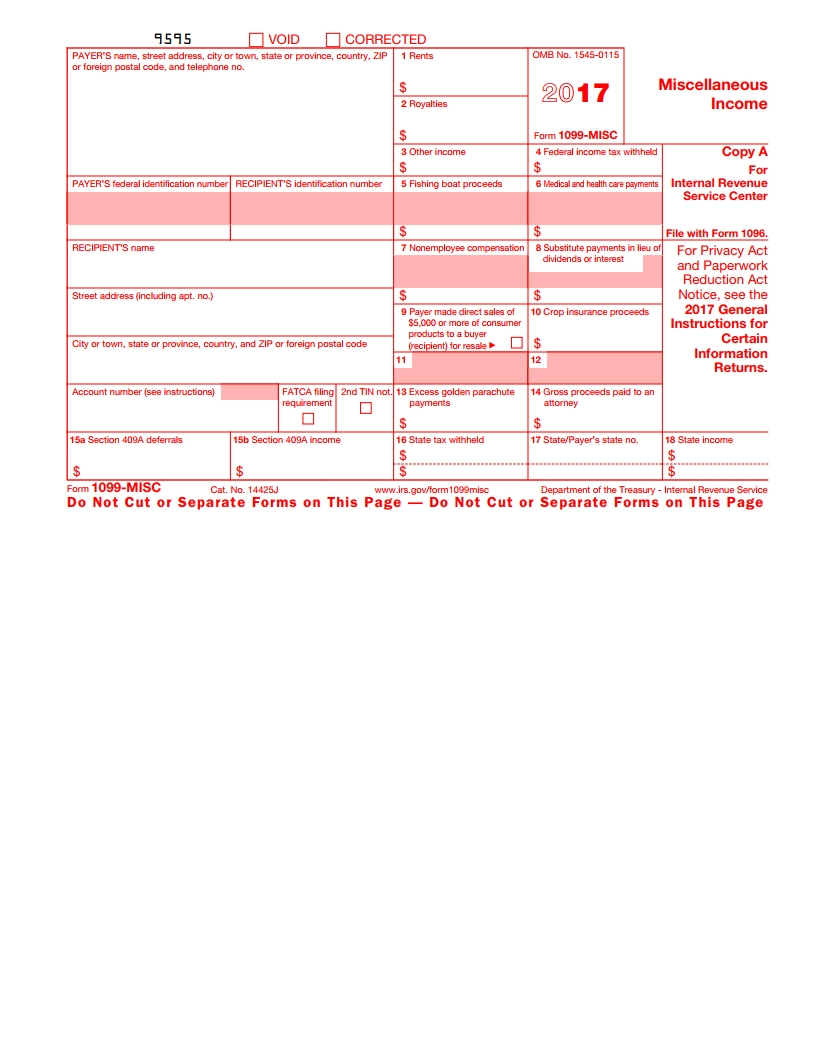

Free Printable 1099 Misc Forms - Free Printable

When it comes to reporting miscellaneous income, the 1099-MISC form is commonly used. Lyanaprintable offers a free downloadable and printable version of the 1099-MISC form. This can be useful for individuals and businesses that need to report various types of income accurately.

When it comes to reporting miscellaneous income, the 1099-MISC form is commonly used. Lyanaprintable offers a free downloadable and printable version of the 1099-MISC form. This can be useful for individuals and businesses that need to report various types of income accurately.

1099 Int Form – Fillable Pdf Template – Download Here!

For individuals and businesses who prefer to fill out forms digitally, a fillable PDF template of the 1099-INT form is available for download. This template allows you to enter the required information electronically, making the process more efficient and reducing the chances of errors.

For individuals and businesses who prefer to fill out forms digitally, a fillable PDF template of the 1099-INT form is available for download. This template allows you to enter the required information electronically, making the process more efficient and reducing the chances of errors.

What Is a 1099 Form, and How Do I Fill It Out? | Bench Accounting

The 1099 form serves an essential purpose, but it can be confusing for many individuals. This article by Bench Accounting outlines what a 1099 form is and provides guidance on how to fill it out accurately. Understanding the form and its requirements can help you comply with tax regulations and avoid potential penalties.

The 1099 form serves an essential purpose, but it can be confusing for many individuals. This article by Bench Accounting outlines what a 1099 form is and provides guidance on how to fill it out accurately. Understanding the form and its requirements can help you comply with tax regulations and avoid potential penalties.

[…]