Introduction:

Are you ready to take up the challenge of saving money? We understand that saving money can be difficult, but with the right mindset and a proper plan, you can achieve your financial goals. In this article, we will present you with a collection of money-saving challenges and provide you with printable resources to make your savings journey exciting and rewarding.

The 52-Week Money Saving Challenge:

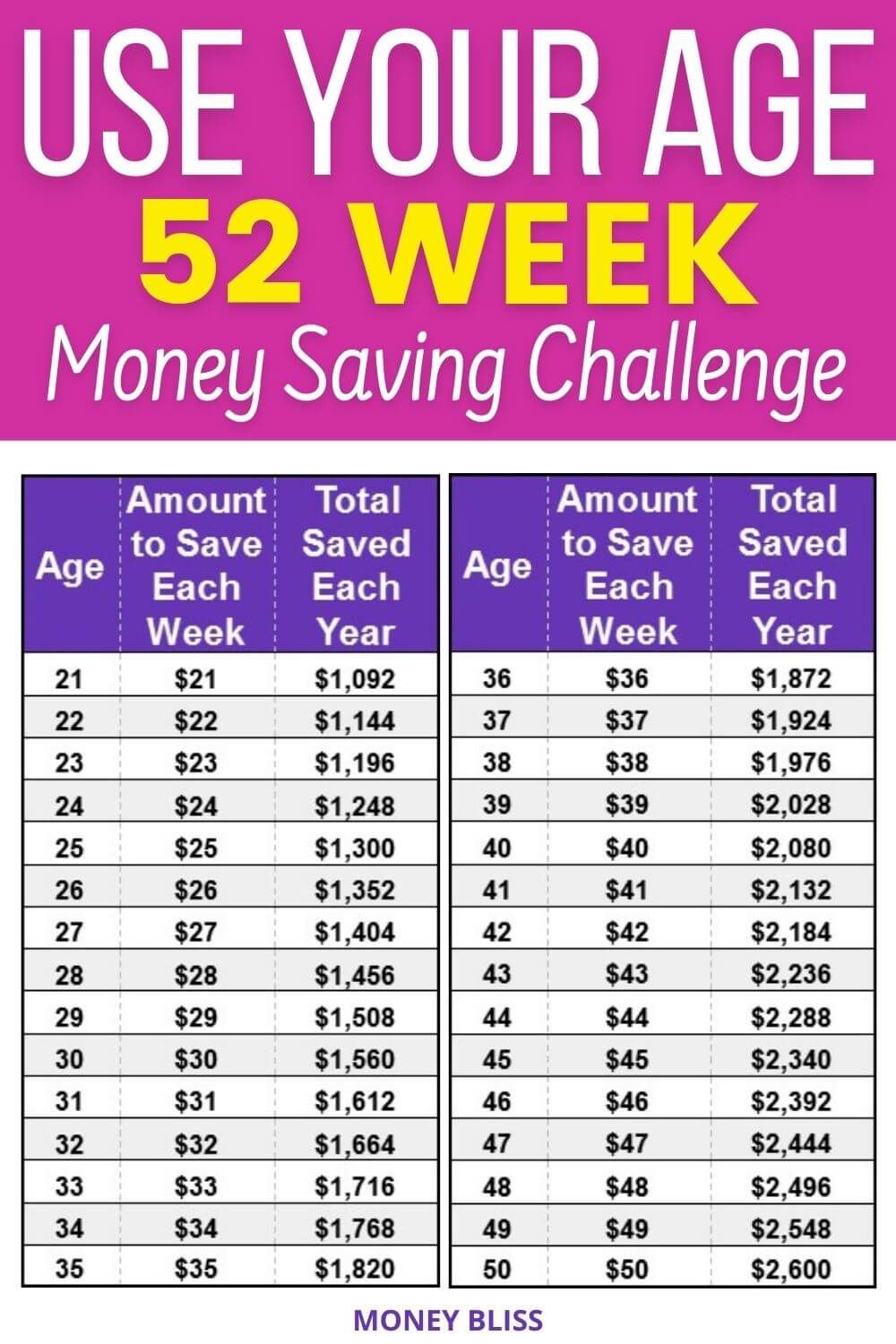

One popular saving challenge that has gained immense popularity is the 52-week money-saving challenge. The concept is simple yet effective. Each week, you save a designated amount of money. As the weeks progress, the amount you save gradually increases. By the end of the challenge, you will have a substantial sum of money saved.

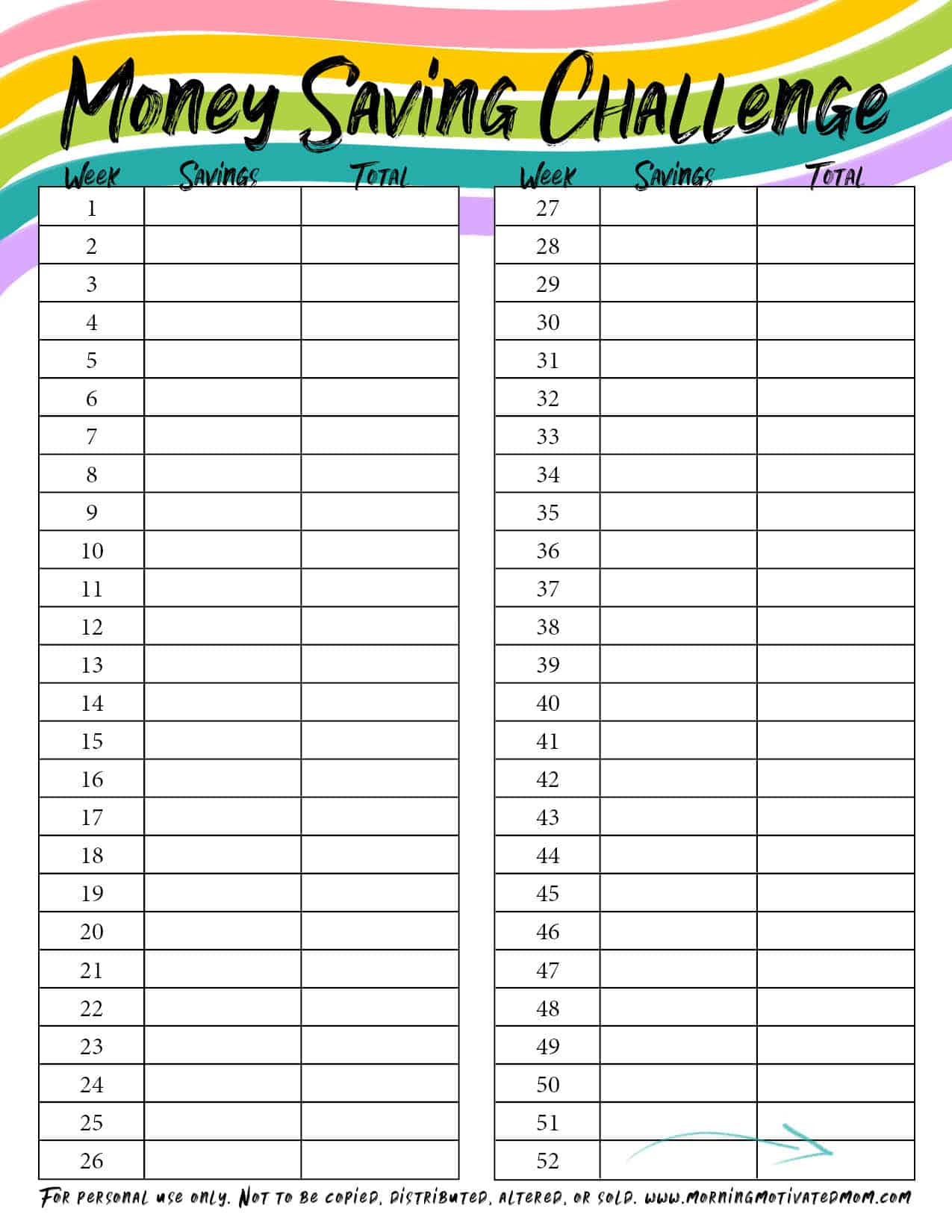

Many websites offer free printable templates for this challenge, making it easy for you to track your progress. You can place these templates on your refrigerator or keep them in your wallet as a constant reminder of your financial goals.

Many websites offer free printable templates for this challenge, making it easy for you to track your progress. You can place these templates on your refrigerator or keep them in your wallet as a constant reminder of your financial goals.

Money Saving Challenge for Kids:

Teaching kids about the importance of saving money is essential for their financial literacy. Luckily, there are money-saving challenges specifically designed for children. These challenges incorporate fun activities and interactive printables to engage kids in the saving process.

By participating in these challenges, children learn about budgeting, setting financial goals, and delayed gratification. It’s a valuable lesson that will benefit them throughout their lives.

By participating in these challenges, children learn about budgeting, setting financial goals, and delayed gratification. It’s a valuable lesson that will benefit them throughout their lives.

Other Money Saving Challenges:

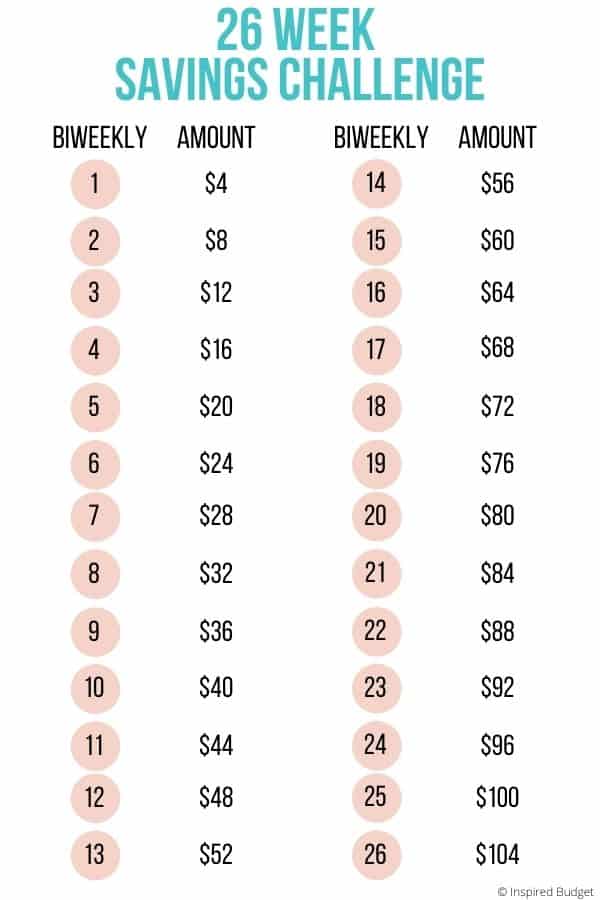

If the 52-week money-saving challenge doesn’t suit your preferences, don’t worry! There are various other saving challenges that you can explore.

One popular alternative is the 365-day money-saving challenge. In this challenge, you save a small amount each day of the year, starting with $1 on day one and increasing by $1 each subsequent day. By the end of the year, your savings will have accumulated to over $1,000!

Additionally, there are challenges that focus on saving specific amounts weekly or monthly. These challenges allow you to set realistic goals based on your financial situation and personal preferences. Some examples include saving $10 per week, $100 per month, or even $1,000 per month for those with more ambitious savings goals.

Additionally, there are challenges that focus on saving specific amounts weekly or monthly. These challenges allow you to set realistic goals based on your financial situation and personal preferences. Some examples include saving $10 per week, $100 per month, or even $1,000 per month for those with more ambitious savings goals.

Tracking Your Progress:

Regardless of the saving challenge you choose, it’s crucial to track your progress along the way. This will help you stay motivated and accountable for your savings goals.

Many printable resources provide tracking tools that allow you to color or check off each milestone as you reach it. This visual representation of progress can be incredibly rewarding and encourage you to continue working towards your financial objectives.

Many printable resources provide tracking tools that allow you to color or check off each milestone as you reach it. This visual representation of progress can be incredibly rewarding and encourage you to continue working towards your financial objectives.

Conclusion:

Saving money is a skill that everyone should cultivate. By embracing money-saving challenges and utilizing the available printable resources, you can develop a healthy habit of saving while having fun along the way. Whether you choose the 52-week challenge, one tailored for kids, or an alternative savings plan, the key is consistency and discipline. Start your savings journey today and witness the positive impact it has on your financial well-being!