When it comes to managing our taxes, there’s no denying that the W-4 form plays a crucial role. This essential document allows us to adjust the amount of federal income tax withheld from our paycheck. Whether you’re looking to fill out a new W-4 form or simply want to understand how it works, we’ve got you covered with this helpful guide.

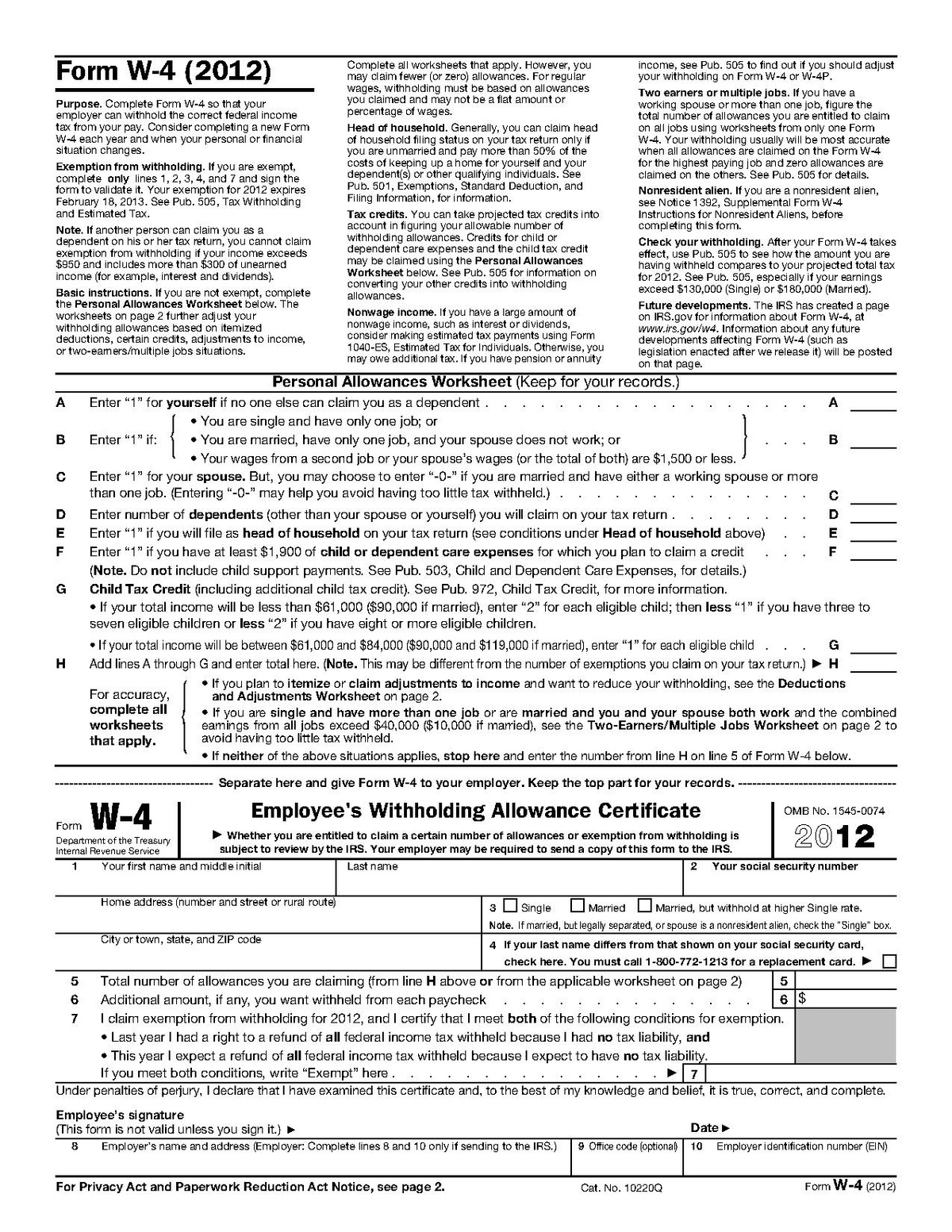

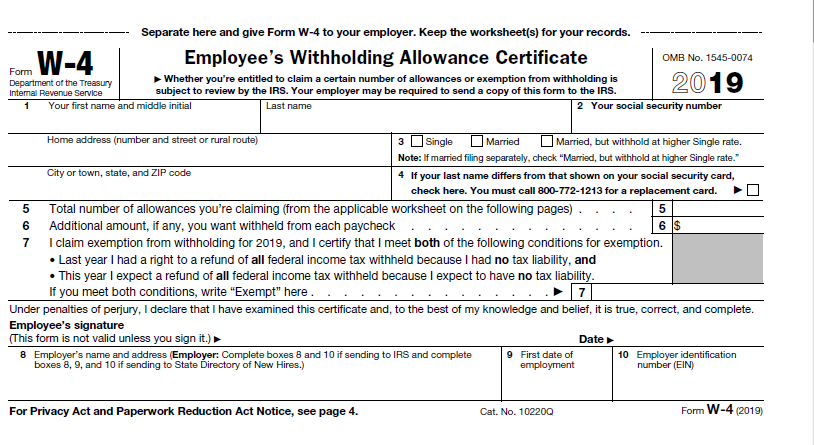

Federal W-4 Worksheet 2020

The Federal W-4 Worksheet for the year 2020 is a printable and fillable online form that enables you to accurately report information such as your filing status, total number of allowances, and any additional withholding amounts. It’s important to complete this form correctly to ensure that the right amount of federal income tax is withheld from your paycheck.

The Federal W-4 Worksheet for the year 2020 is a printable and fillable online form that enables you to accurately report information such as your filing status, total number of allowances, and any additional withholding amounts. It’s important to complete this form correctly to ensure that the right amount of federal income tax is withheld from your paycheck.

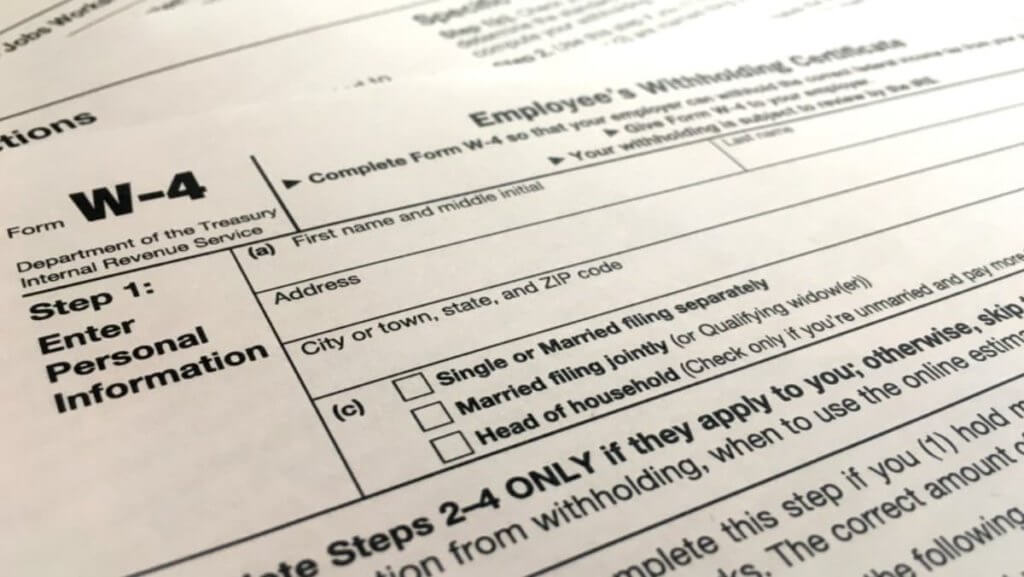

How To Fill Out Your W-4 Tax Form

If you’re unsure about how to fill out your W-4 Tax Form, don’t worry - you’re not alone. This informative video on YouTube provides a step-by-step tutorial on how to accurately complete the form, ensuring that you provide the necessary information to your employer and avoid any potential tax-related issues.

If you’re unsure about how to fill out your W-4 Tax Form, don’t worry - you’re not alone. This informative video on YouTube provides a step-by-step tutorial on how to accurately complete the form, ensuring that you provide the necessary information to your employer and avoid any potential tax-related issues.

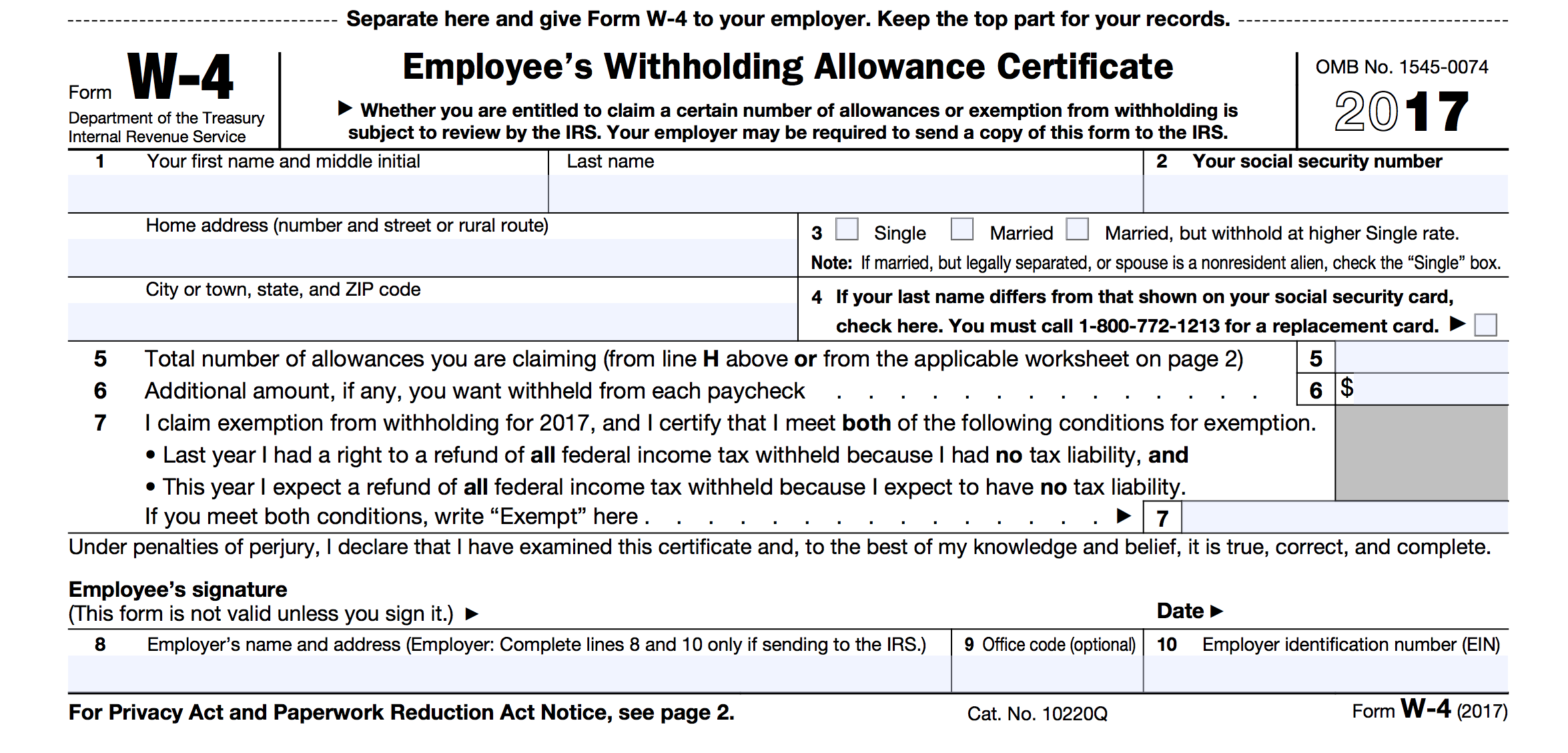

Printable W-4 Forms for 2022

As we enter the year 2022, it’s important to have access to updated W-4 forms. These printable forms allow you to fill them out manually, providing all the necessary information regarding your filing status, allowances, and additional withholding amounts. Keeping your W-4 form up to date ensures that your tax withholdings align with your current financial situation.

As we enter the year 2022, it’s important to have access to updated W-4 forms. These printable forms allow you to fill them out manually, providing all the necessary information regarding your filing status, allowances, and additional withholding amounts. Keeping your W-4 form up to date ensures that your tax withholdings align with your current financial situation.

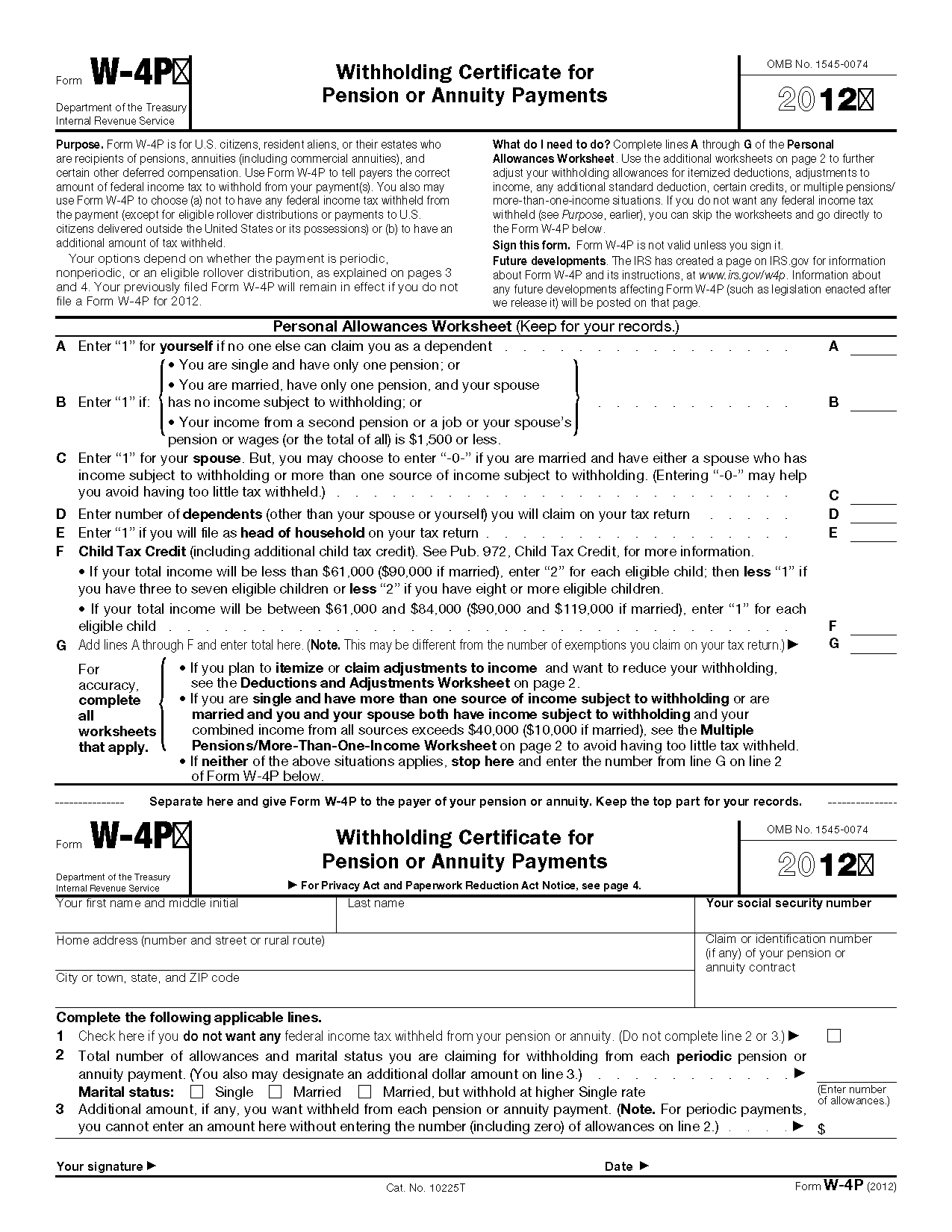

Il W-4 2020

For individuals residing in Illinois, the Il W-4 form for the year 2020 is essential. This form allows you to declare your withholding status and make adjustments to ensure accurate tax calculations. Understanding how to fill out this form correctly is crucial in maintaining proper tax withholdings throughout the year.

For individuals residing in Illinois, the Il W-4 form for the year 2020 is essential. This form allows you to declare your withholding status and make adjustments to ensure accurate tax calculations. Understanding how to fill out this form correctly is crucial in maintaining proper tax withholdings throughout the year.

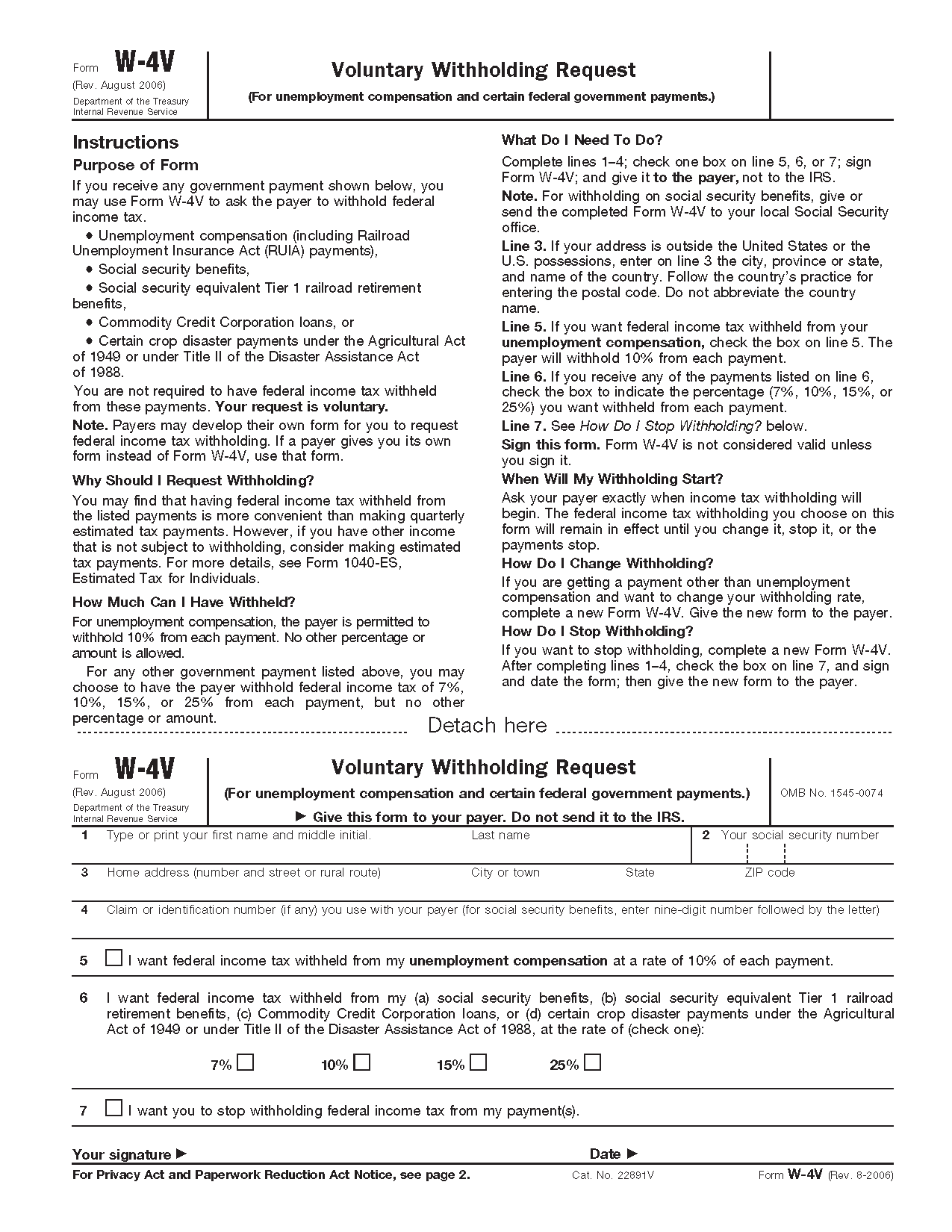

W-4V Form SSA Printable

If you want to voluntarily request federal income tax withholding from your Social Security benefits, the W-4V form is the way to go. This printable form provides instructions on how to complete it and serves as a request for a specific withholding percentage to be deducted from your benefits. Ensure that you accurately fill out this form to avoid any inconvenience related to your tax withholdings.

If you want to voluntarily request federal income tax withholding from your Social Security benefits, the W-4V form is the way to go. This printable form provides instructions on how to complete it and serves as a request for a specific withholding percentage to be deducted from your benefits. Ensure that you accurately fill out this form to avoid any inconvenience related to your tax withholdings.

W-4 Completed Sample

Looking for an example of a completed W-4 form? This printable sample showcases a filled-out W-4 form for the year 2022. It provides you with a visual representation of how to accurately complete each section, including personal information, filing status, allowances, and additional withholding amounts. Utilize this sample as a reference to ensure the correct completion of your own W-4 form.

Looking for an example of a completed W-4 form? This printable sample showcases a filled-out W-4 form for the year 2022. It provides you with a visual representation of how to accurately complete each section, including personal information, filing status, allowances, and additional withholding amounts. Utilize this sample as a reference to ensure the correct completion of your own W-4 form.

Wisconsin W-4 Form Printable

If you reside in Wisconsin, the Wisconsin W-4 form is specifically tailored to meet the state’s tax withholding requirements. This printable form allows you to report necessary information such as your filing status and exemptions accurately. Make sure to complete this form accordingly to align your tax withholdings with Wisconsin state guidelines.

If you reside in Wisconsin, the Wisconsin W-4 form is specifically tailored to meet the state’s tax withholding requirements. This printable form allows you to report necessary information such as your filing status and exemptions accurately. Make sure to complete this form accordingly to align your tax withholdings with Wisconsin state guidelines.

Fill And Sign W4 Form Online for Free

For those seeking a convenient way to fill out and sign their W4 form online, DigiSigner offers a user-friendly platform. This online tool allows you to digitally complete and sign your W4 form, eliminating the need for physical paperwork. Ensure that you follow the instructions provided by DigiSigner for a seamless and secure online filling and signing experience.

For those seeking a convenient way to fill out and sign their W4 form online, DigiSigner offers a user-friendly platform. This online tool allows you to digitally complete and sign your W4 form, eliminating the need for physical paperwork. Ensure that you follow the instructions provided by DigiSigner for a seamless and secure online filling and signing experience.

W-4 Forms for 2021-2022

As we transition from 2021 to 2022, it’s important to have access to the latest W-4 forms. These printable forms allow you to provide accurate information regarding your filing status, allowances, and additional withholding amounts. Ensure that you download and complete the 2022 version to keep your tax withholdings up to date.

As we transition from 2021 to 2022, it’s important to have access to the latest W-4 forms. These printable forms allow you to provide accurate information regarding your filing status, allowances, and additional withholding amounts. Ensure that you download and complete the 2022 version to keep your tax withholdings up to date.

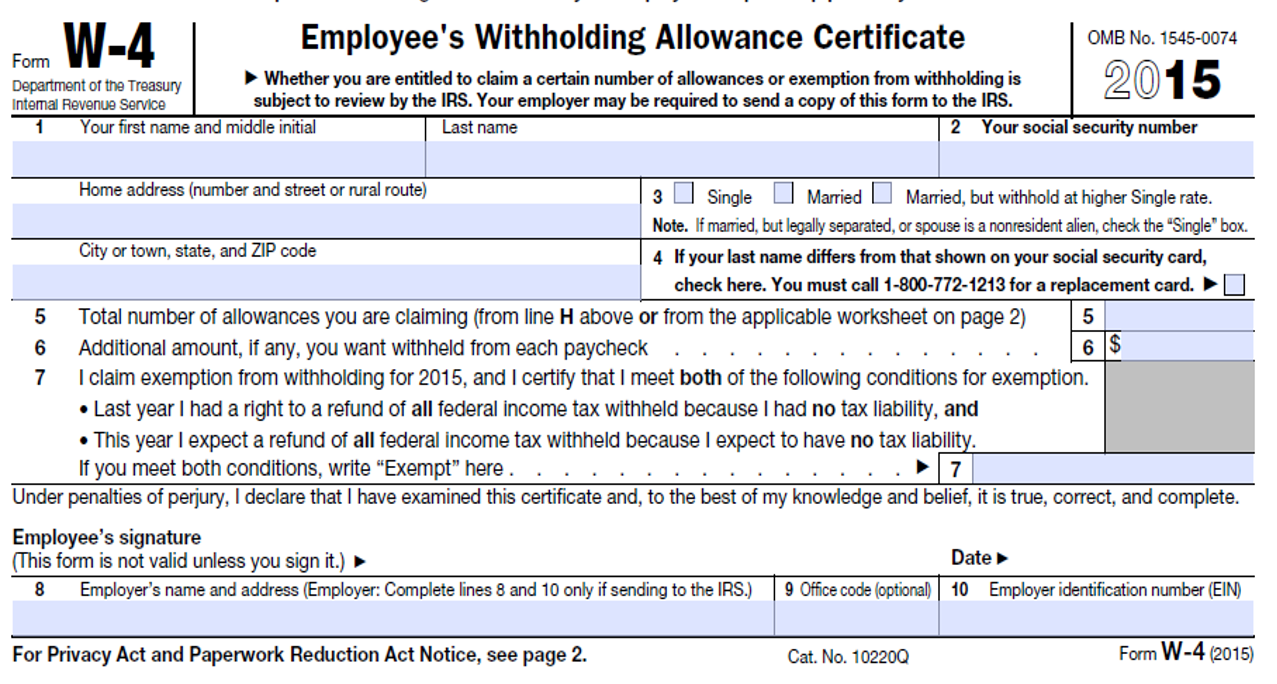

W4 2015 Form Printable

Although the year is now 2022, it’s worth mentioning that the IRS W4 form for the year 2015 is still relevant in some cases. This printable form is useful for those who may need to refer to the previous version for comparison or historical purposes. However, it’s important to note that using the most up-to-date version of the W-4 form is always recommended for accurate tax withholdings.

Although the year is now 2022, it’s worth mentioning that the IRS W4 form for the year 2015 is still relevant in some cases. This printable form is useful for those who may need to refer to the previous version for comparison or historical purposes. However, it’s important to note that using the most up-to-date version of the W-4 form is always recommended for accurate tax withholdings.

Managing your taxes effectively begins with understanding and appropriately completing the W-4 form. Whether you prefer to fill out a printed copy manually or utilize online tools for a digital experience, ensure that you provide accurate information regarding your filing status, allowances, and any additional withholding amounts. By doing so, you can ensure that your tax withholdings align with your financial circumstances, promoting financial stability and peace of mind.